IMF’s World Economic Outlook projects a rosy picture

The anticipated hard landing has receded, while risks to global growth are broadly balanced

image for illustrative purpose

According to IMF, there is a need to focus on enhancing revenue generation, prioritising spending, keeping a check on rising debts, structural reforms, debt sustainability and accelerating convergence towards higher income level

The liquidity easing resorted during and in the aftermath of Covid-19 has led to too much inflation all over the world and every central bank had to take steps to fight the rising inflation and to bring under control, by substantially increasing their reference rates. However, it is only recently that there has been signs of softening of inflation, though not to the level they have been mandated to achieve, thereby delaying the rate cut whereas they have been holding back the enhanced reference rates with status quo in their monetary policy. The substantial quantitative easing has been replaced by quantitative tightening which will impact the GDP growth.

Apart from inflation, there are other causes leading to the low growth, like the Ukraine-Russia war, the Israel-Hamas conflict, disturbance the in Red Sea, which have adversely impacted supplies while food prices have been hit by the climate crisis.

Addressing high rise inflation and high-debt coupled with slow economic growth will affect all countries is dependent on how each country handles the situation.

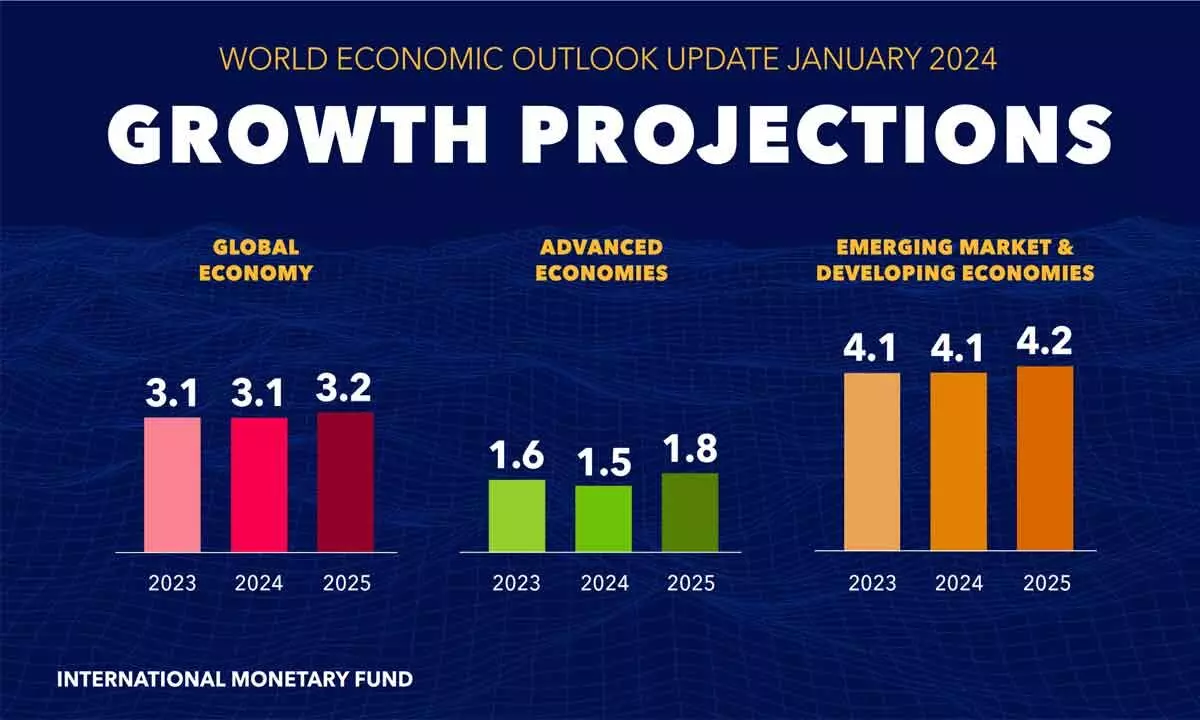

Amid this comes a breather from the IMF, which in its January World Economic Outlook update has revised growth projection from the level estimated in October to 3.1% in 2024 and 3.2% in 2025. However this projected growth is much below the historical average growth of 3.8% (2009-2019).This is primarily due to greater than expected resilience in the United States and several large emerging economies, and China’s fiscal support.

The global headline inflation is expected to fall to 5.8% in 2024, which is still high. IMF feels that the anticipated hard landing has receded and risks to global growth are broadly balanced.

On the positive side, faster disinflation could lead to further easing of financial conditions. A revised fiscal policy could imply temporarily higher growth but at the risk of higher adjustment later on. Hence, both the government and the central bank have to have a perfect balance between growth and inflation with suitable policy reforms as well as adequate control on liquidity.

According to IMF, there is a need to focus on enhancing revenue generation, prioritising spending, keeping a check on rising debts, structural reforms, debt sustainability and accelerating convergence towards higher income level.

It may be recalled that its recent Union Budget, the Centre has focussed more on fiscal consolidation, in spite of pressure to bring in populist spending in view of the upcoming elections.

India is planning to reach a fiscal deficit of 5.8% for 2023-24 as against 5.9% projected earlier and has kept a fiscal deficit target of 5.1% for 2024-25 and has reiterated its plans to bring to 4.5% by 2025-26. With the projected GDP growth of 7% for 2023-24 India would have achieved 7% growth in successive three years despite the global challenges. It is also necessary that the country charters a plan to keep the fiscal deficit within three per cent as mandated by the Fiscal Responsibility and Budget Management (FRBM) Act.

On the other side, RBI has stuck to its stand that the time to loosen its control on headline inflation is yet to come. It has RBI focussed on achieving the desired CPI inflation target of four per cent on durable basis even though recent inflation has started easing but much above the RBI's target. There has been substantial easing in core inflation. However CPI inflation in January eased to 5.10% from 5.69% in December. The same was at 4.25% in May and the highest at 7.44% last year. The central bank has projected headline inflation CPI for Q1, Q2, Q3 and Q4 FY 2024-25 at 5%, 4%, 4.6% and 4.7%, respectively. RBI has also projected 6.5% real GDP growth for 2024- 2025. Currently it is expected that easing and cutting repo rate may begin in the second half of next financial year, even though some may expect it by this June.

The downside risks listed by IMF for global growth are: 1. Commodities prices spikes and geopolitical and weather shocks; 2. Persisting core inflation, requiring a tighter monetary policy stance; 3. Flattering of growth in China; 4. A disruptive turn to fiscal consolidation.

Faster disinflation, slower than assumed withdrawal of fiscal support, faster economic recovery in China, AI and supply side reforms can have upside risks to global growth.

Even though India has managed the global crisis reasonably better with a combination of prudent fiscal policies and RBI’s apt monetary policy, going forward it has to move carefully with the downside risks to global growth as listed by IMF and aim for sustainable growth with the least disruptions.

Hence the policy priorities listed by IMF like managing the final descent of inflation, rebuilding buffers to prepare for future shocks as it is likely in this period of uncertainty and achieving debt sustainability by prudent borrowing, focus on mobilising domestic revenue, addressing spending rigidities and strengthening resilience through multilateral cooperation, particularly in debt resolution for lower less developed countries, and cooperation are required to mitigate the effects of climate change and facilitate green energy transition. In this regard, India's borrowings are mostly from domestic sources and external debt of lesser level of $ 624.7 billion as at the end of March 2023 whereas it has high forex reserves of $623 billion by the end of 2023 thereby covering more than 92.6% of the external debt as at the end of March 2023. The country has also achieved the target set for Nationally Determined Contribution (NDC) well ahead of its time, while the cumulative electric power installed capacity from non-fossil fuel based energy sources is 186 46 MW, which is 43.81% of the total cumulative electric installed capacity. Similarly, the emission intensity of its GDP has been reduced by 33% between 2005 and 2019.

However, India has to continue to focus on alternative renewable energy towards its target of net-zero emissions by 2070.

(The author is former Chairman & Managing Director of Indian Overseas Bank)